Understanding Bariatric Surgery and Its Coverage in Georgia

Bariatric surgery is a medical procedure designed to assist individuals struggling with obesity. It involves various surgical techniques that help limit food intake or nutrient absorption, leading to significant weight loss.

Understanding insurance coverage for weight loss surgery is crucial. Without proper coverage, patients may face substantial out-of-pocket expenses. Knowing what insurance covers bariatric surgery in Georgia can make the difference between accessible treatment and financial strain.

1. Types of Bariatric Procedures and Their Benefits

Bariatric surgery is a medical intervention designed to assist in obesity treatment by altering the digestive system to facilitate weight loss. This approach is often recommended for individuals who have been unable to achieve significant weight reduction through diet and exercise alone.

Common Types of Bariatric Procedures

- Gastric Bypass: Creates a small stomach pouch and reroutes the small intestine, reducing food intake and nutrient absorption.

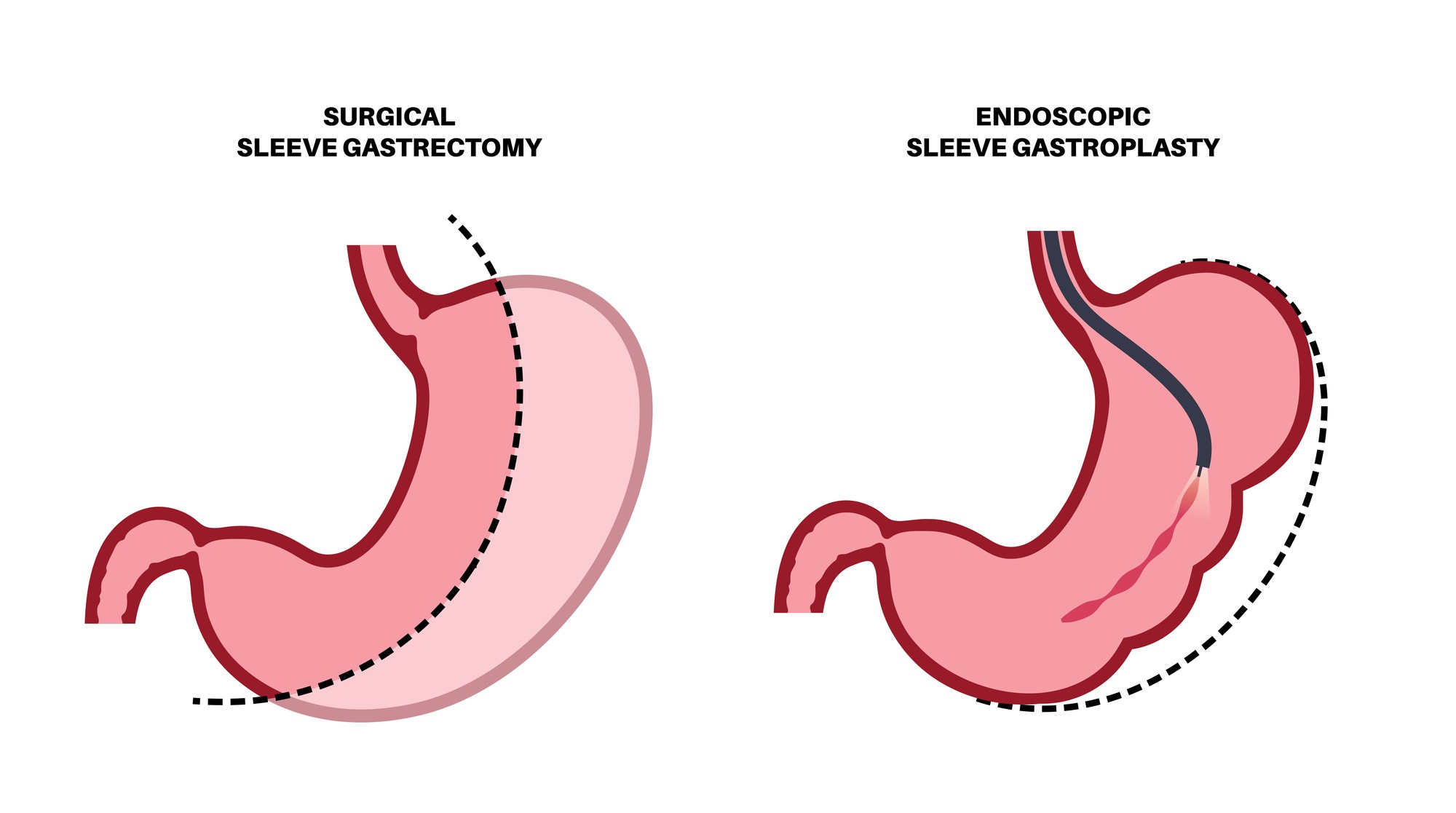

- Sleeve Gastrectomy: Involves removing a portion of the stomach to create a tube-like structure, limiting the amount of food that can be consumed.

- Duodenal Switch: Combines aspects of gastric bypass and sleeve gastrectomy, significantly reducing stomach size and altering the digestive process to limit calorie absorption.

Potential Benefits

- Surgical Complications: As with any major surgery, risks include infection, bleeding, and adverse reactions to anesthesia.

- Nutritional Deficiencies: Altered digestion may lead to deficiencies in essential nutrients, requiring lifelong supplementation.

- Long-term Management: Continuous medical follow-up is essential to monitor health status and manage any complications that may arise.

Understanding these procedures helps patients make informed decisions about their weight loss surgery options, considering both the advantages and potential challenges.

2. Insurance Providers in Georgia: Who Covers Bariatric Surgery?

Major health insurance providers in Georgia include Anthem Blue Cross (BCBS), Aetna, Cigna, Humana, and UnitedHealthcare. Each of these insurers has unique policies regarding bariatric surgery coverage. Understanding the specifics of each provider’s coverage can significantly impact your decision-making process.

Anthem Blue Cross (BCBS)

- Eligibility: Requires a Body Mass Index (BMI) of 35+ with comorbidities or 40+ without.

- Pre-requisites: Participation in a weight loss program and past attempts at weight loss through diet and exercise are often required.

- Centers of Excellence: Surgeries must be performed at designated facilities.

Aetna

- Medical Necessity: Specific criteria must be met, including BMI requirements and pre-operative evaluations.

- Similarities to BCBS: Similar guidelines but may have different documentation needs.

Other Insurers

- Cigna: Offers bariatric surgery coverage but varies by plan specifics.

- Humana: Coverage availability depends on individual policy terms.

- UnitedHealthcare: Policies may include exclusions for obesity treatment; thorough review is necessary.

Variability in coverage policies among these insurers means it’s crucial to review your individual policy documents. Always consult directly with your insurance provider to understand the exact requirements and limitations of your plan. This proactive approach helps in navigating the complexities of insurance coverage for bariatric surgery.

3. Anthem Blue Cross (BCBS) Coverage for Bariatric Surgery

Anthem Blue Cross (BCBS) has specific eligibility criteria for approving bariatric surgery claims. Understanding these criteria is essential for anyone considering weight loss surgery under this insurer.

Eligibility Criteria

To qualify for coverage, patients must meet the following conditions:

- Body Mass Index (BMI):

- A BMI of 40 or greater without comorbidities.

- A BMI of 35 or greater with at least two significant comorbidities such as diabetes, hypertension, or sleep apnea.

Role of BMI and Comorbidities

BMI plays a critical role in determining eligibility. Patients with a higher BMI generally have a stronger case for coverage, especially when coupled with serious health issues. Documenting these comorbidities can significantly impact insurance approval.

Centers of Excellence Requirement

BCBS requires that surgeries be performed at designated Centers of Excellence. These centers are specialized facilities recognized for their expertise in bariatric procedures and adherence to high standards of care. Choosing a Center of Excellence not only meets BCBS requirements but also ensures better patient outcomes.

Understanding these key aspects helps you navigate Anthem BCBS’s coverage policies effectively, setting you on the right path toward your weight loss goals.

4. Aetna's Approach to Covering Weight Loss Surgery Costs

Aetna coverage criteria for bariatric surgery share similarities with Anthem Blue Cross (BCBS) but also exhibit distinct differences. Like BCBS, Aetna mandates specific medical necessity requirements which must be met by policyholders to qualify for coverage.

Key Requirements for Aetna Coverage:

- Body Mass Index (BMI): Aetna typically requires a BMI of 40 or greater, or a BMI of 35 or greater accompanied by at least one significant comorbidity, such as diabetes or hypertension.

- Pre-operative Evaluations: Patients may need to undergo comprehensive evaluations including nutritional and psychological assessments to ensure they are suitable candidates for surgery.

- Previous Weight Loss Attempts: Documented evidence of previous unsuccessful attempts at weight loss through diet and exercise is often a prerequisite.

- Supervised Weight Loss Program: Participation in a medically supervised weight loss program prior to surgery can be necessary.

Aetna also emphasizes that procedures must be deemed medically necessary. This includes proving that the surgery is essential for the patient’s health and not merely for cosmetic reasons. Surgeries should be performed at accredited facilities that meet specific quality standards.

Comparatively, while both Aetna and BCBS require documentation of medical necessity and previous weight loss efforts, their specific criteria and processes may vary. For instance, the extent and type of pre-operative evaluations might differ. Understanding these nuances can help potential patients better navigate their insurance options.

5. The Georgia State Health Benefit Plan: What State Employees Should Know About Their Coverage Options

For state employees in Georgia, the State Health Benefit Plan (SHBP) offers coverage for bariatric surgery under specific conditions. Understanding these specifics can help you navigate your insurance options effectively.

Coverage Specifics

- Eligibility Criteria: Like other insurers, the SHBP requires that patients meet certain medical necessity criteria. This typically includes a BMI of 35 or greater with comorbidities, or a BMI of 40 or greater without comorbidities.

- Pre-Approval Process: State employees must undergo a comprehensive pre-approval process, which often involves documented evidence of previous weight-loss attempts through diet and exercise.

- Designated Facilities: Surgeries must be performed at designated Centers of Excellence to ensure high standards of care and successful outcomes.

Benefits and Limitations

- Comprehensive Coverage: The SHBP provides comprehensive coverage for various bariatric procedures, including gastric bypass and sleeve gastrectomy.

- Limitations: Despite the broad coverage, there may be limitations such as waiting periods or mandatory participation in pre-surgery weight management programs.

Understanding the state employee health benefit plan helps you make informed decisions about your healthcare options. Always review your policy documents thoroughly and consult with your HR department for detailed information.

General Considerations for Insurance Approval Process

Review Your Insurance Policy Thoroughly

Understanding your insurance policy is crucial. Before seeking approval for bariatric surgery, make sure to review the policy exclusions and specific criteria for coverage. This includes checking:

- BMI requirements

- Comorbidity documentation

- Pre-operative evaluations

Consult with Your HR Department

If you are employed and covered through a company-provided plan, your employer’s Human Resources (HR) department can be an invaluable resource. They can help you understand:

- Specific coverage details

- Any required documentation or procedures

- Potential out-of-pocket costs

By working closely with HR, you can clarify any uncertainties about what insurance covers bariatric surgery in Georgia.

The Approval Process: What to Expect When Seeking Insurance Coverage for Bariatric Surgery

When it comes to getting your insurance claim approved for bariatric surgery, there are a few important steps you need to know about. Generally, you can expect to hear back from your insurance company within 30 days after you’ve submitted all the necessary documents. However, this timeline can vary depending on the specific insurance provider and how complicated your case is.

Key Points to Consider:

- Thorough Documentation: Making sure that all the required paperwork is complete and accurate is crucial. This includes medical records, proof of previous weight loss attempts, and any mandatory evaluations before the surgery.

- Effective Communication: Stay in touch with your insurance provider regularly throughout the process. Keep a record of all conversations, follow up on any pending documents, and quickly clarify any uncertainties to prevent delays.

Other Insurer

Other insurance companies that cover bariatric surgery include:

- CIGNA HEALTHSPRING

- GEHA-ASA

- HUMANA

- MEDICARE CAHABA GBA

- Meritain Health

- OMAHA INSURANCE COMPANY

- TRICARE EAST

- TRICARE FOR LIFE

- UMR

- UNITED HEALTHCARE

- GROUP RESOURCES

- HUMANA MEDICARE

- AARP

- MEDICARD

- CHAMPVA

- SELMAN & COMPANY,

- GOLDEN RULE INSURANCE COMPANY

- SUREST HEALTH, FRIDAY HEALTHPLAN

- TRICARE SUPPLEMENT

- BANKERS LIFE AND CASUALTY COMPANY

- PRAIRIE STATES

- USAA

- ALLIED BENEFIT SYSTEMS INC

- CLOVER HEALTH

- SONDERS HEALTH PLAN

- BRIGHTSPRING HEALTH

- ALLIANT HEALTH PLAN

- ADMINISTRATIVE CONCEPTS, and SONDERS.

Self-Payment Options if Insurance Doesn't Cover Your Procedure

For patients facing exclusions or lack of insurance coverage for bariatric surgeries, self-payment options provide an alternative route to achieve weight loss goals.

Self-pay options for uninsured patients include:

- Fixed-price packages: Many bariatric surgery clinics offer fixed-price packages that cover pre-operative consultations, the surgical procedure, and post-operative care. These packages can simplify the financial planning process.

- Financing plans: Some healthcare providers partner with financing companies to offer payment plans. These plans allow you to spread the cost over several months or years, making it more manageable.

- Medical credit cards: Specialized credit cards like CareCredit are designed specifically for medical expenses, including bariatric surgery. They often come with promotional financing options.

- Discounts and promotions: Clinics occasionally offer discounts or promotional rates for self-paying patients. It’s worth inquiring about any current offers.

Choosing a self-payment option requires careful consideration of your financial situation and a thorough understanding of what each package includes.

Navigating Your Insurance Options Wisely!

When considering weight-loss surgery in Georgia, it’s crucial to conduct thorough research on your potential insurers’ policies. Understanding what insurance covers bariatric surgery in Georgia can save you time and ensure you’re adequately prepared. Engage with your insurance provider, review policy documents meticulously, and consult with your employer’s HR department if necessary. This proactive approach helps in navigating insurance options wisely, leading to informed decisions about your health and financial responsibilities.

Let's Verify If Your Insurance Covers Bariatric Surgery

Let’s see if your insurance covers bariatric surgery

Understanding your insurance coverage is a crucial step in the journey toward weight-loss surgery. It can significantly influence your financial planning and decision-making process.

Steps to Verify Your Insurance Coverage

- Gather Your Information

- Before you start the verification process, collect essential details:

- Your insurance policy number

- Group number (if applicable)

- The name of the policyholder

- Contact information for your insurance provider

- Visit the Verification Link

- Head over to the following link for a streamlined verification process:

- Free Insurance Verification

- Complete the Online Form

- Fill out the required fields carefully. You may need to provide:

- Personal information (name, date of birth, etc.)

- Details about your current health conditions

- Information regarding prior weight-loss attempts or treatments

- Submit Your Request

- After filling out the form, submit it for review. Ensure all information is accurate to avoid delays.

- Await Confirmation

- Once submitted, a representative will reach out to inform you about:

- Whether your policy covers bariatric surgery

- Any prerequisites or documentation needed for approval

- Estimated co-pays or out-of-pocket expenses

Why Verification Matters

- Avoiding Unexpected Costs: Knowing what your plan covers helps prevent surprise medical bills.

- Clarifying Coverage Details: Different policies may have varying criteria for coverage, including pre-approval requirements.

- Streamlining Your Journey: Early verification can expedite scheduling your consultation with a surgeon.

Make sure to take this step seriously; it can significantly affect your path to achieving a healthier lifestyle.